Corporate Income Tax (CIT)

Under the CIT Law, taxpayers are classified as resident or non-resident taxpayers. The resident taxpayers are liable for Mongolian CIT from their worldwide income including both income earned in Mongolia and in foreign countries. The non-resident taxpayers are liable for Mongolian CIT from their income which is either (a) earned in Mongolia (such income can be taxed by the non-resident’s permanent establishment in Mongolia), or (b) sourced from Mongolia (such sourced income can be taxed by withholding mechanism).

There are the following four categories of taxable income:

- Income from activities (income from business activities, sale of rights, shares and securities);

- Income from property (rent, royalties, dividends, and interest);

- Income from the sale of property (both immovable and movable); and

- Other income.

Tax rates:

- 10% on the first MNT 6 billion on the net income from business activities.

- 25% on excess profits over the first MNT 6 billion on the net income from business activities.

- 1% can apply to entities with revenue of up to MNT 300 million. This is not applicable to entities operating in mining, petroleum, alcoholic beverages and tobacco sectors.

- 90% tax credit can apply to entities with revenue of up to MNT 1.5 billion. This is not applicable to entities operating in mining, petroleum, alcoholic beverages and tobacco sectors.

- 10% In case there is a tax Ultimate Beneficial Owner (UBO) ownership change as a result of a sale of shares, the transaction is deemed a ‘sale of rights’ and subject to 10% CIT on a net basis. The tax base for the transaction can be determined either by the share purchase agreement or the value of the associated mining license or land use/possess right. The Ministry of Finance approved the methods for defining the tax base for the sale of rights transactions.

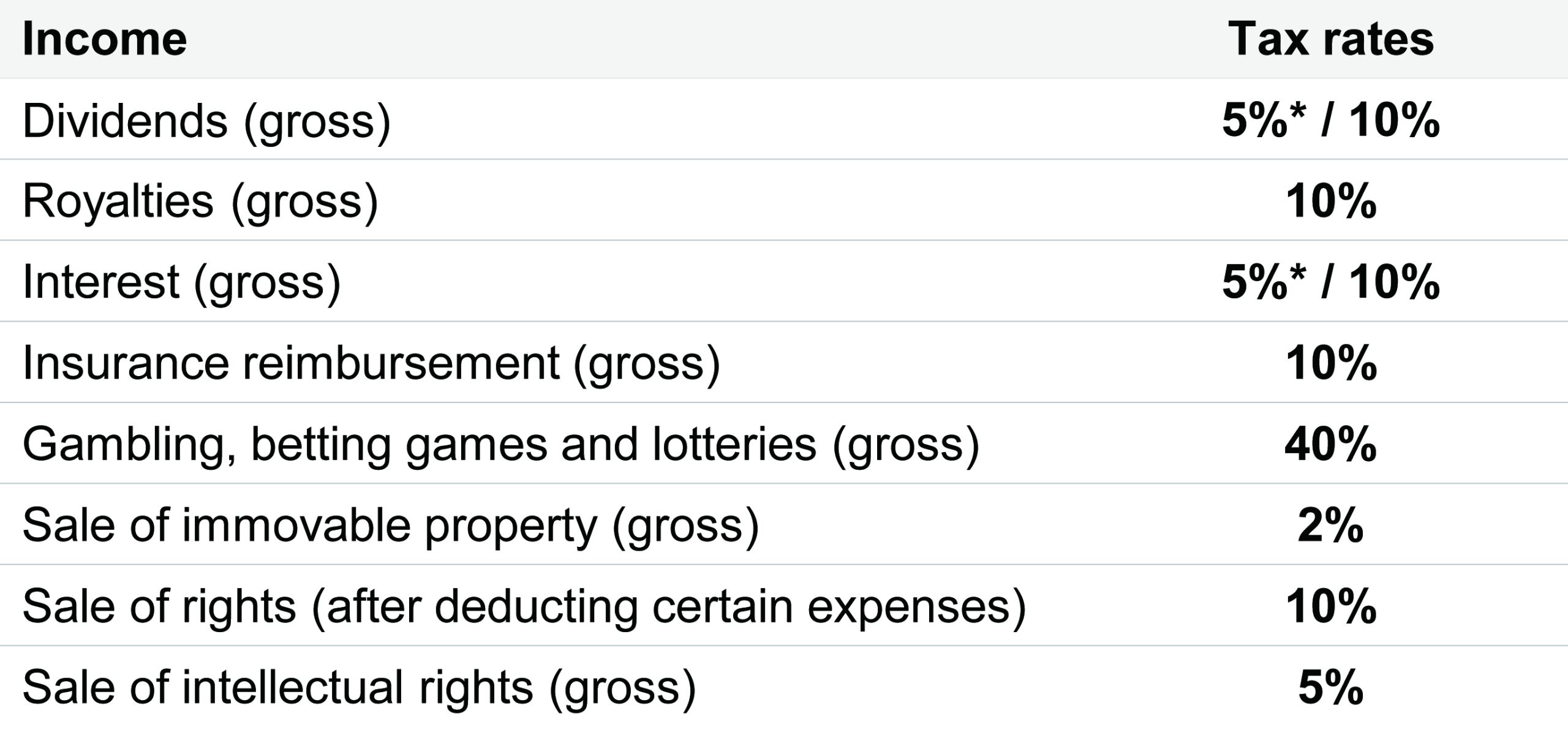

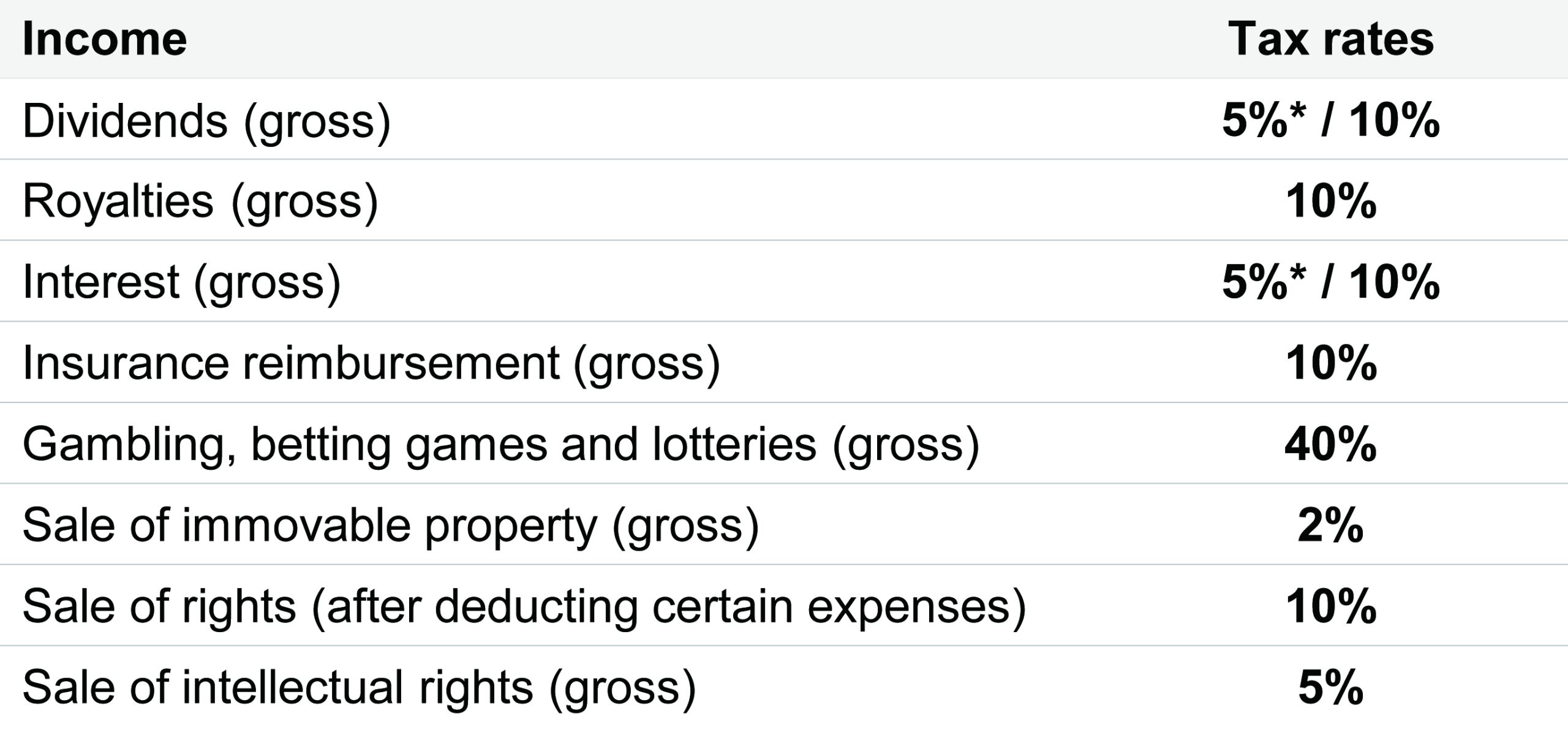

Certain types of income may be taxed at different rates for resident taxpayers:

CIT rates for resident taxpayers:

*Applicable to interest income earned by a resident taxpayer (who does not hold mineral, radioactive mineral and petroleum exploration and mining license) from debt instrument traded at foreign and domestic market through initial and secondary public offering.

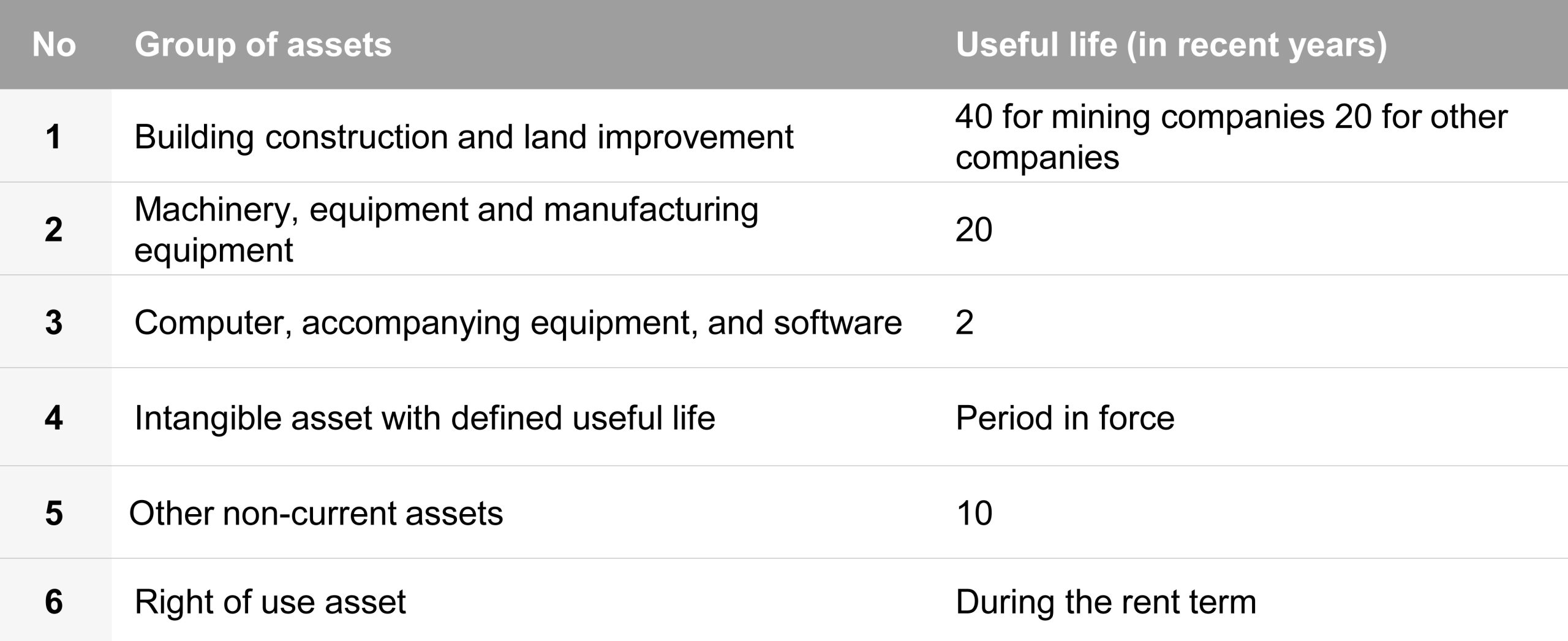

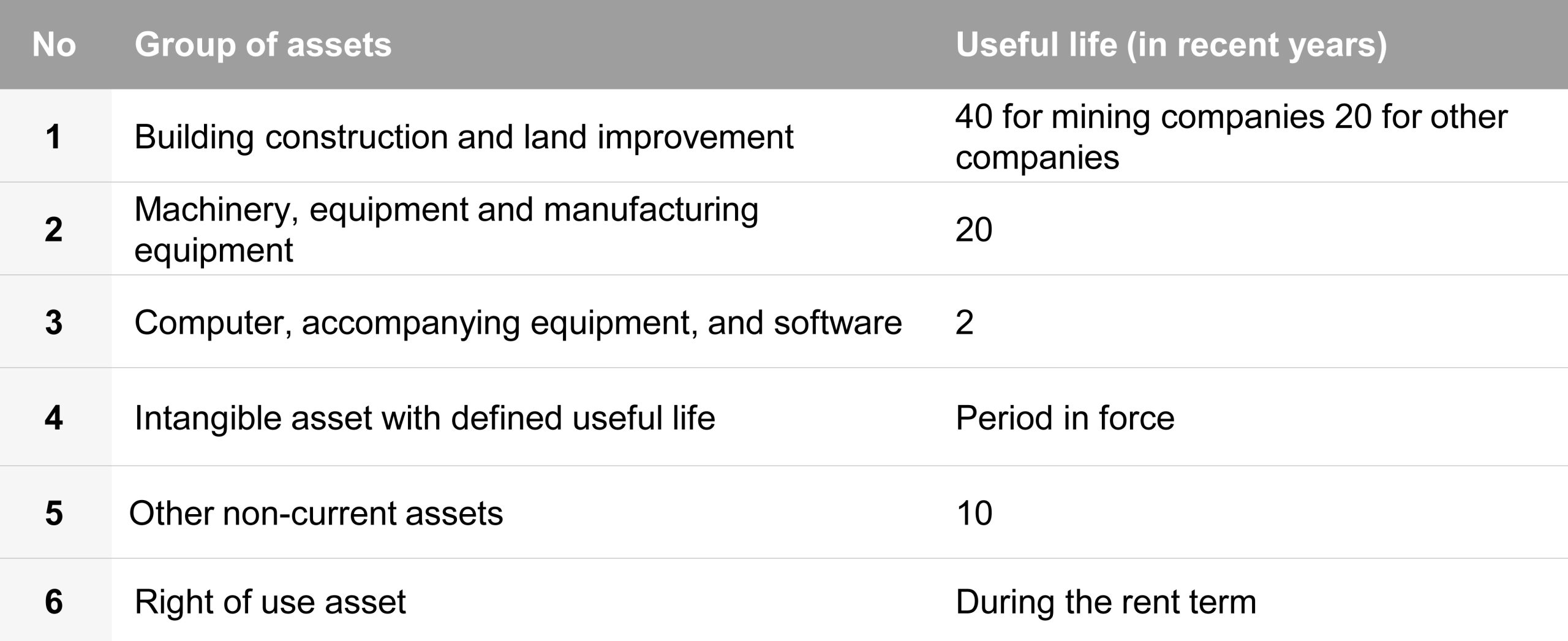

Depreciation

For tax purposes, depreciation is calculated using the straight line method over the useful economic life of the asset that depends upon the nature of the asset, ranging from 2 years for IT equipment to 25 years for buildings and constructions for the companies except those holding mineral, radioactive mineral, petroleum exploration and mining licenses:

Depreciation of assets:

Losses:

- Losses can be carried forward for up to 4 years.

- Limited to 50% of the taxable profit in any year.

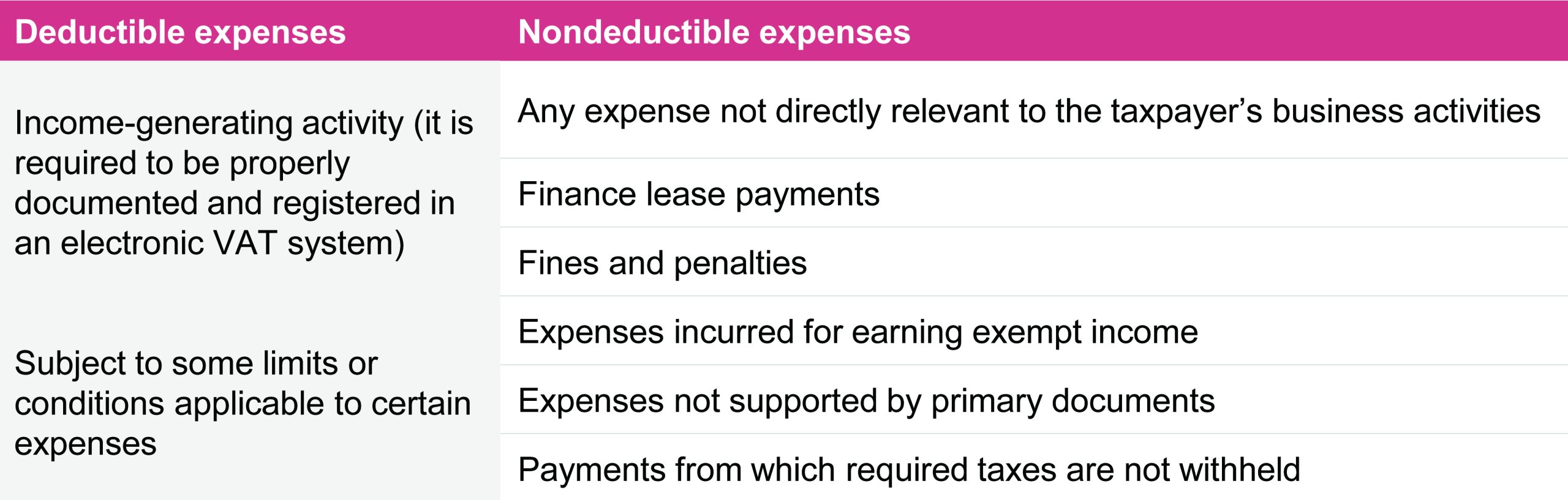

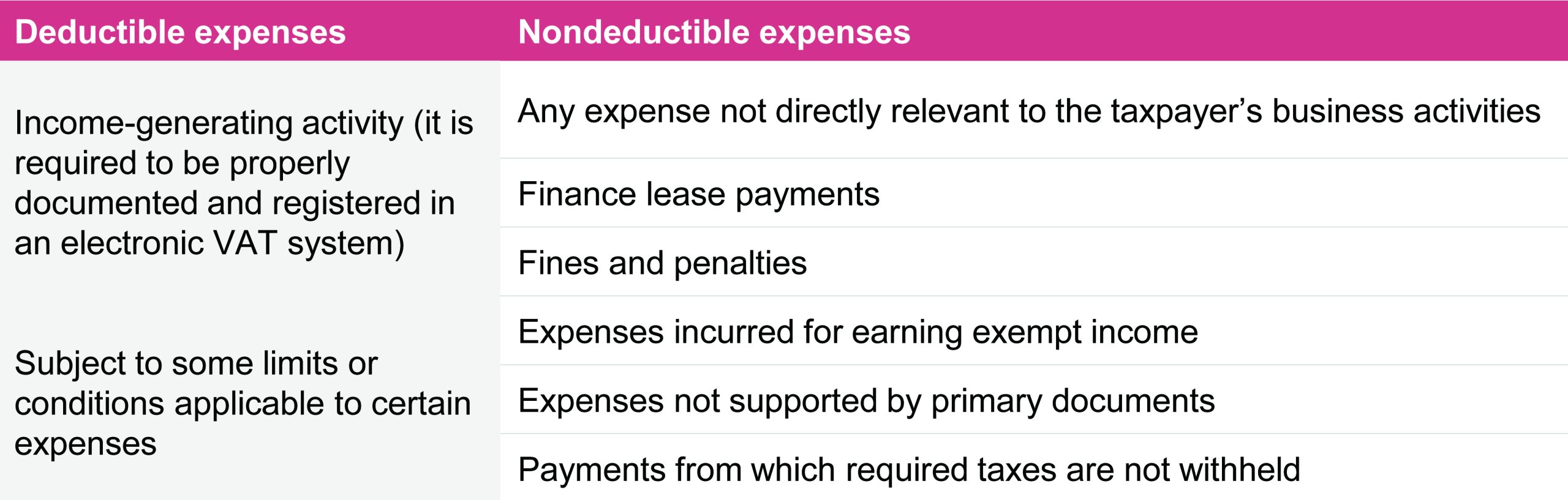

Deductible and non-deductible expenses:

Thin capitalization rule:

Following three different limits applied on interest expenses under the thin capitalization rule:

- Deductible interest expense incurred on a loan received from the related parties shall be limited to 30% of the EBIDTA (sales revenue minus interest expense , depreciation and amortization);

- Debt-to- ‘previously invested capital’ ratio of 3:1 applies to a loan received from investors. Interest paid in excess of this ratio will not be deductible and it will be treated as a dividend; and

- For the loan received from a resident taxpayer shareholder individual, interest expense shall not be deductible at all.

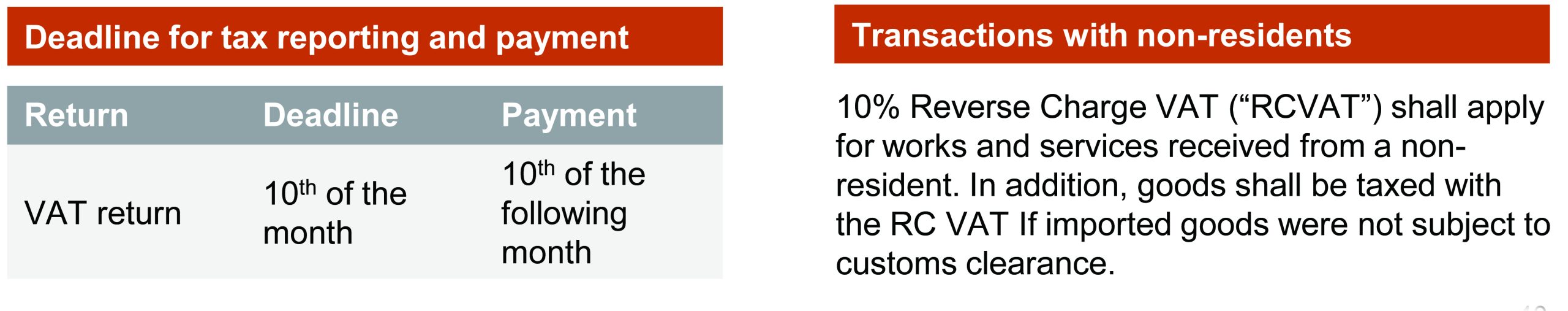

Deadline for tax reporting:

Depending on the taxable income of a prior year, the CIT reporting frequency is determined as follows:

- Taxpayers with a taxable profit of more than MNT 6 billion report on a quarterly basis;

- Taxpayers with a taxable profit of less than MNT 6 billion report twice a year.

- All taxpayers report annually regardless of their taxable income.

CIT reporting deadline:

Transactions with non-residents:

Non-resident taxpayer’s service income earned from Mongolia is subject 20% withholding tax under the CIT Law. The 20% domestic withholding tax may be reduced or eliminated by the applicable double tax treaty provided

- all the supporting documents are in place (this includes a tax residency certificate, issued by the competent authority in a foreign country, plus primary documents relevant for a particular type of transaction),

- no permanent establishment of the foreign entity is created in Mongolia and

- a foreign company is a beneficial owner of such categories of income, like dividend, interest etc.

Obligation for withholding, reporting and paying such tax rests with the Mongolian customer who provides such income to a non-resident taxpayer.