Company incorporation

Establishing a legal presence in Mongolia

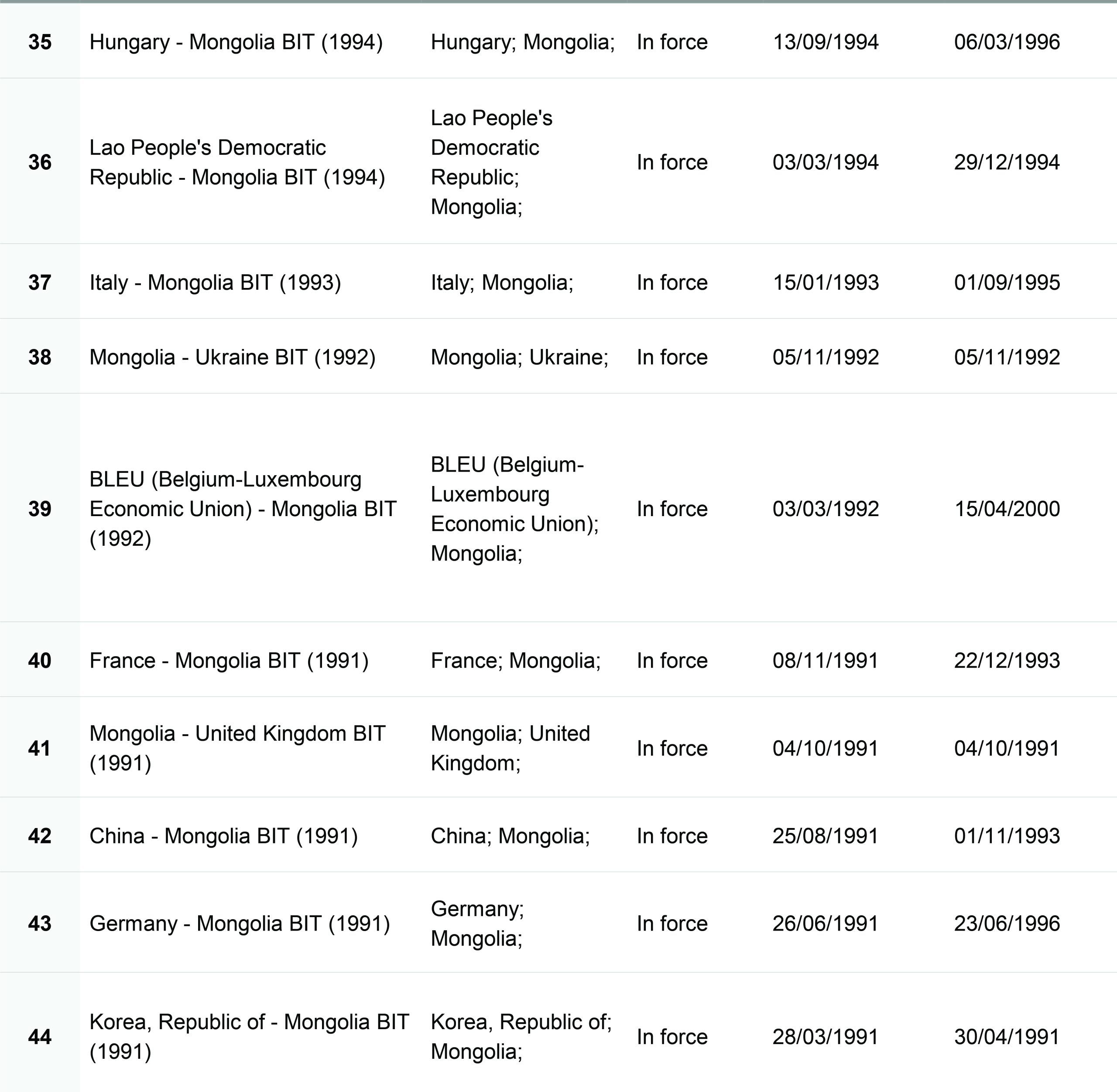

In Mongolia, foreign investors conduct their activities by acquiring new or existing company shares or establishing their legal presence. The most common types of establishments by foreign investors are a foreign-invested limited liability company, a representative office or a permanent establishment.

Comparison of common types of legal establishments

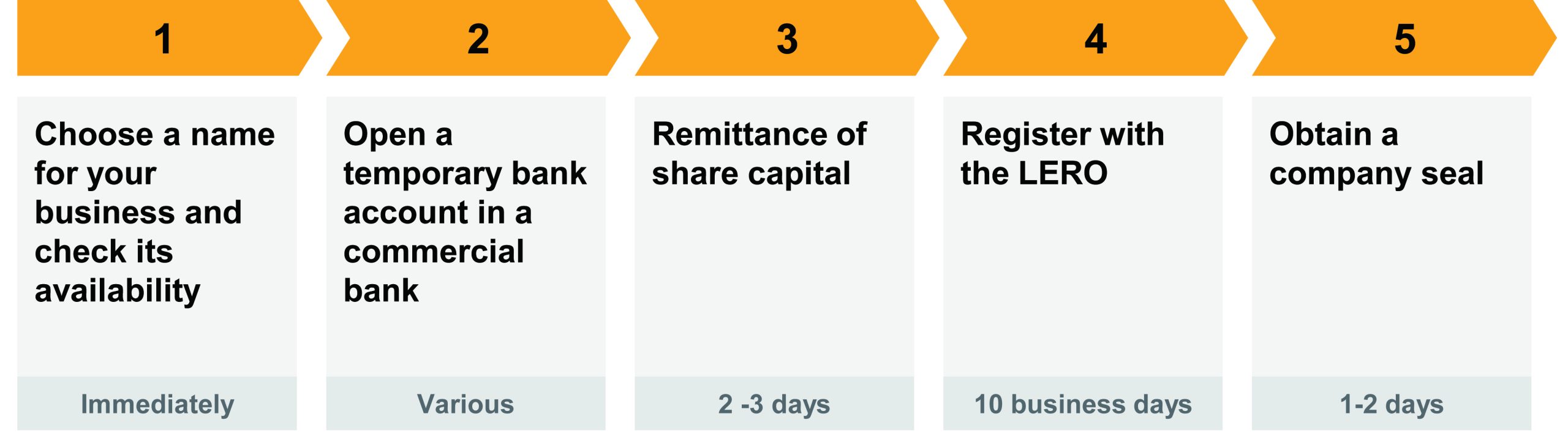

Incorporation procedure

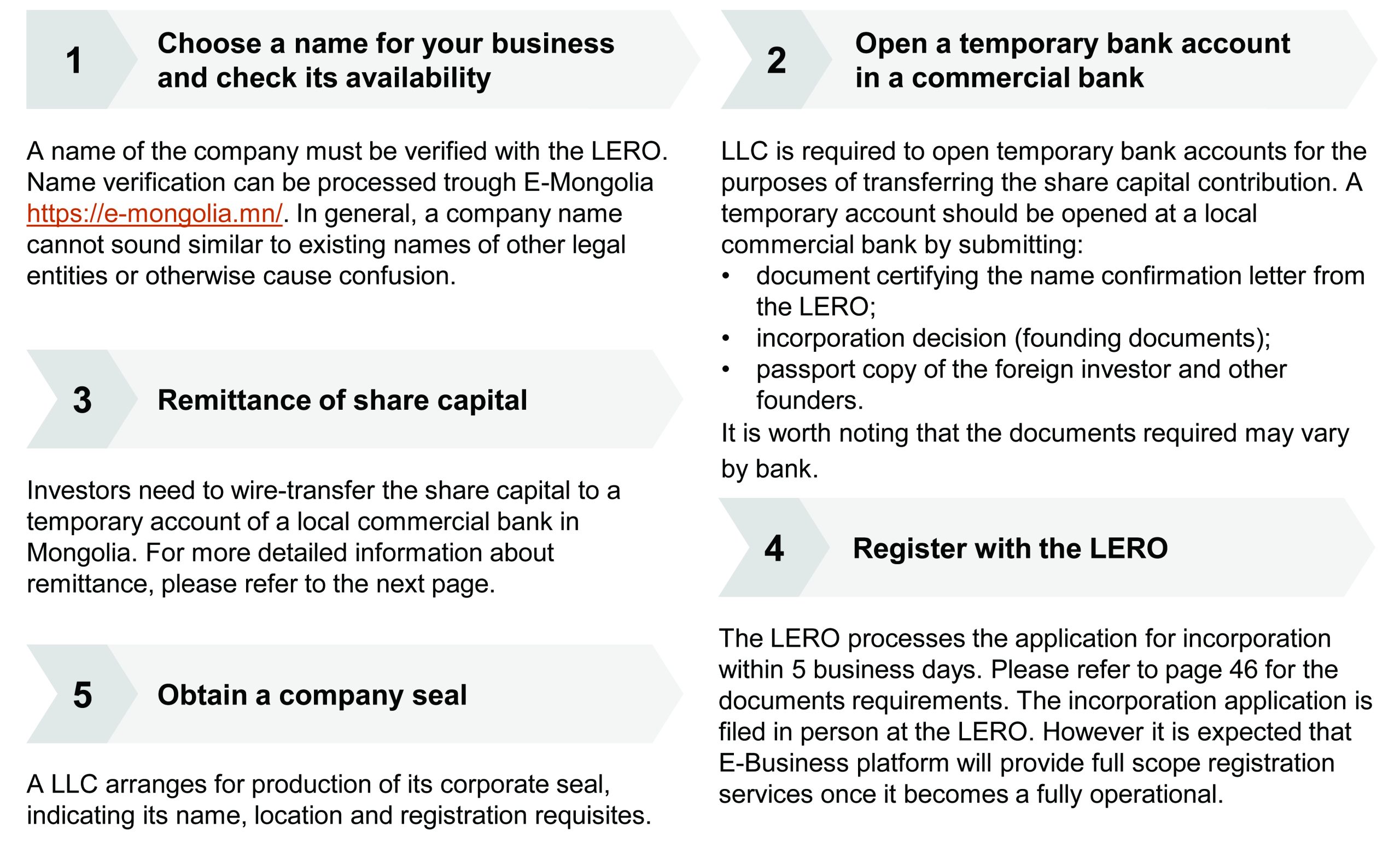

The incorporation of a limited liability company (LLC) in Mongolia is required to be registered with LERO. The registration procedure with the LERO takes 10 business days. After establishing an LLC, it is mandatory to register with respective tax and social insurance offices. A foreign-invested LLC incorporation procedure is as follows:

Considering the preparatory stage (preparation and formalization of the required documents) and post-registration actions (collection of the registration certificates from the LERO), the incorporation of the LLC usually takes about one month.

Documents

List of documents required for establishing anLLC in Mongolia:

- Application forms;

- Name verification sheet of a company;

- Receipt of paying state stamp duty fee (MNT 750,000 (approx. USD 220) for a foreign-invested company);

- Founding resolution and meeting minutes (if it has two or more shareholders);

- Charter;

- Shareholders Agreement (if it has 2 or more shareholders);

- Document proving the official address of the company (it can be a copy of a certificate of immovable property or lease agreement);

- Evidence of investment (for the foreign-invested company, the minimum share capital amount is 100,000 USD per foreign investor);

- Passport copy of shareholders, ultimate beneficial owners and executive director; and

- Power of attorney (where an authorized representative files an application).

If the required documents are executed in a foreign country, they must be apostilled.

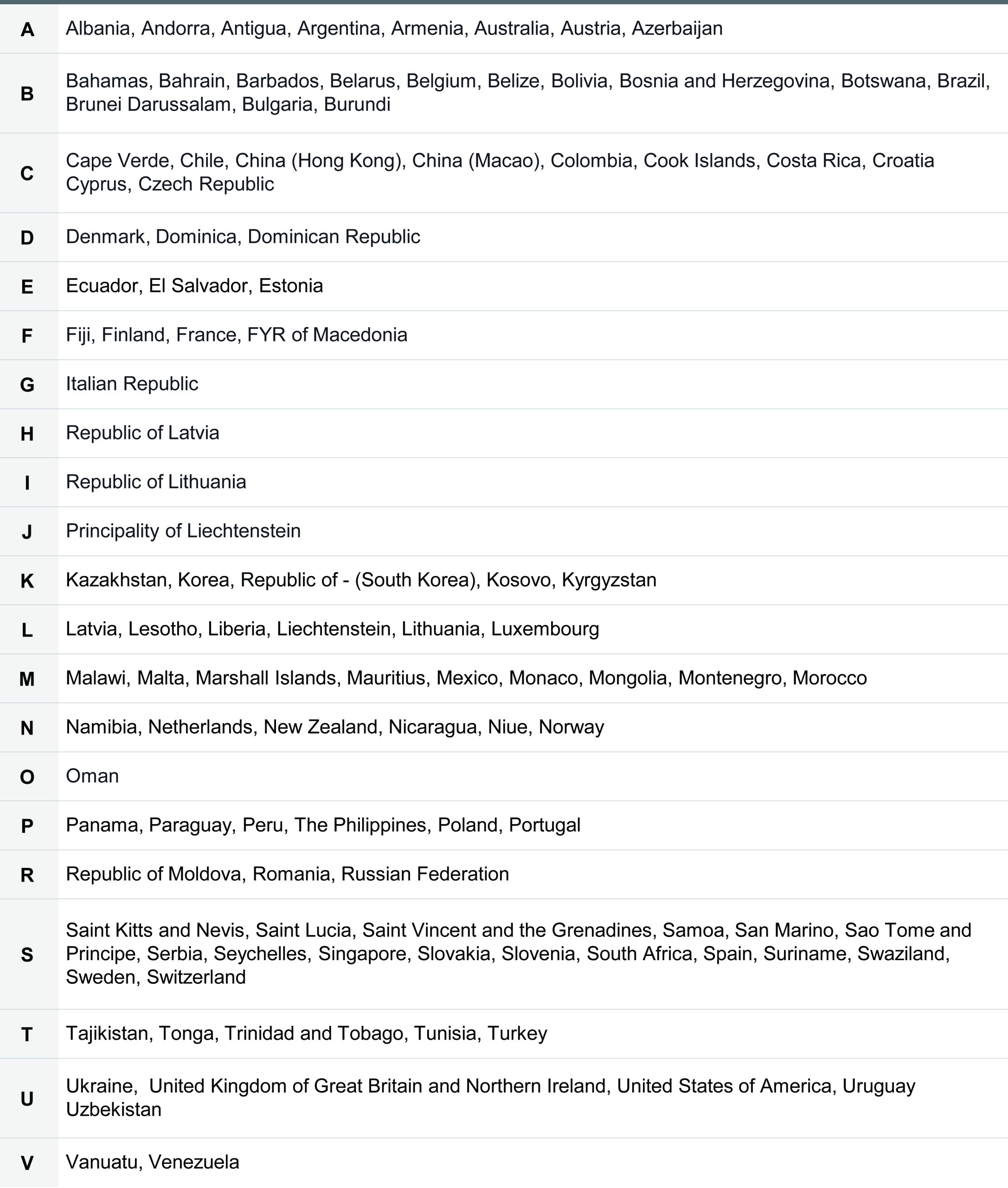

Please refer a List of signatory countries of the Hague Convention (Apostille Treaty). In the case of non-signatory nations to the convention, a legalization of documents at the Mongolian diplomatic mission abroad is required.

Signatory Countries to the Apostille Treaty

Incorporation procedure

Post registration actions

After incorporating a foreign-invested company, it is mandatory to register with the respective tax and social insurance offices. The following key documents are required for the registration:

- An official request;

- A copy of the state registration certificate, and charter;

- A passport copy of an executive director; and

- A power of attorney (authorizing an authorized representative to apply).

Changes related to the registration of a company

Companies in all forms are required to notify and register changes of certain corporate information of the company with the LERO within 15 business days from the date of relevant decision.

Examples of information changes:

- Where share capital amount is changed by transfer of equity shares by an investor or capital reduction;

- Where the company name, business activity, and company address are changed;

- Where the ultimate beneficial owner information is changed; and

- Where the shareholder is changed etc.

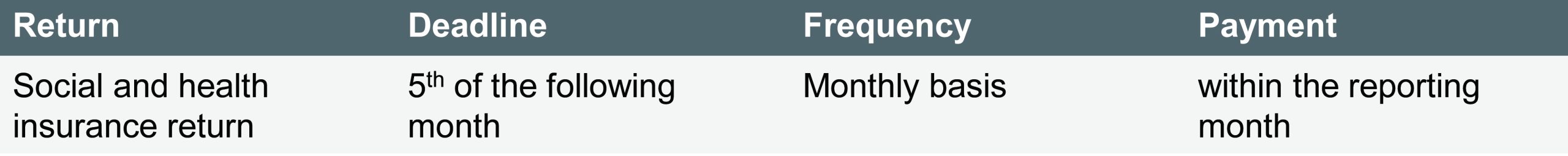

Deadline for reporting and payment

Deadline for reporting and payment

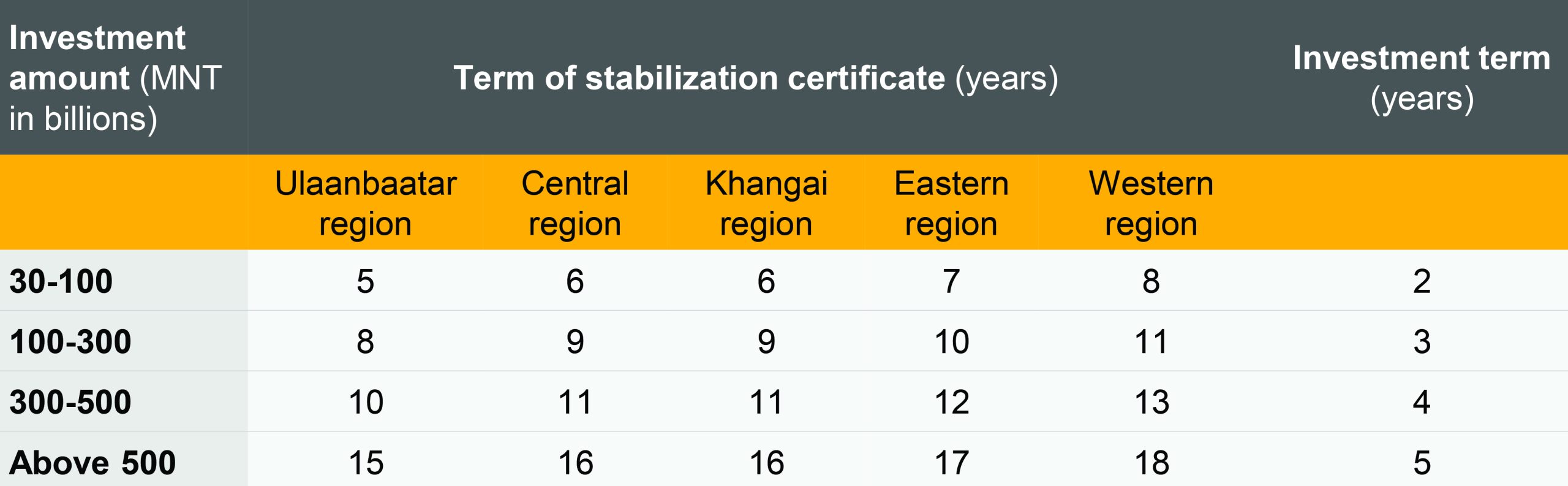

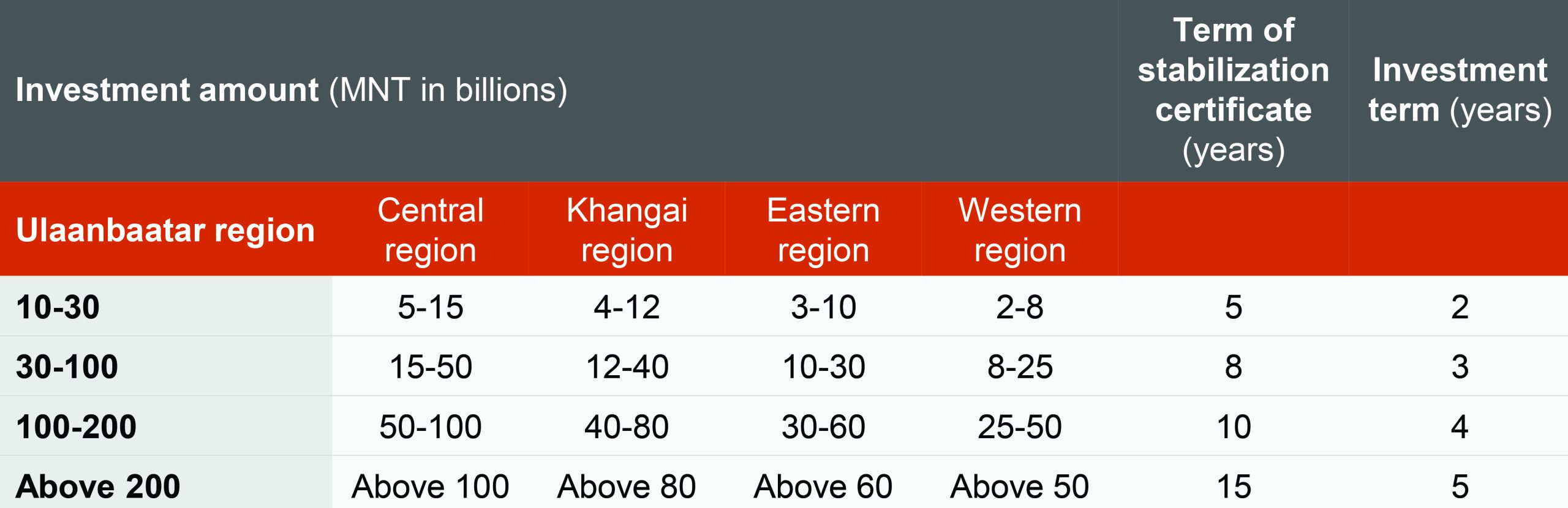

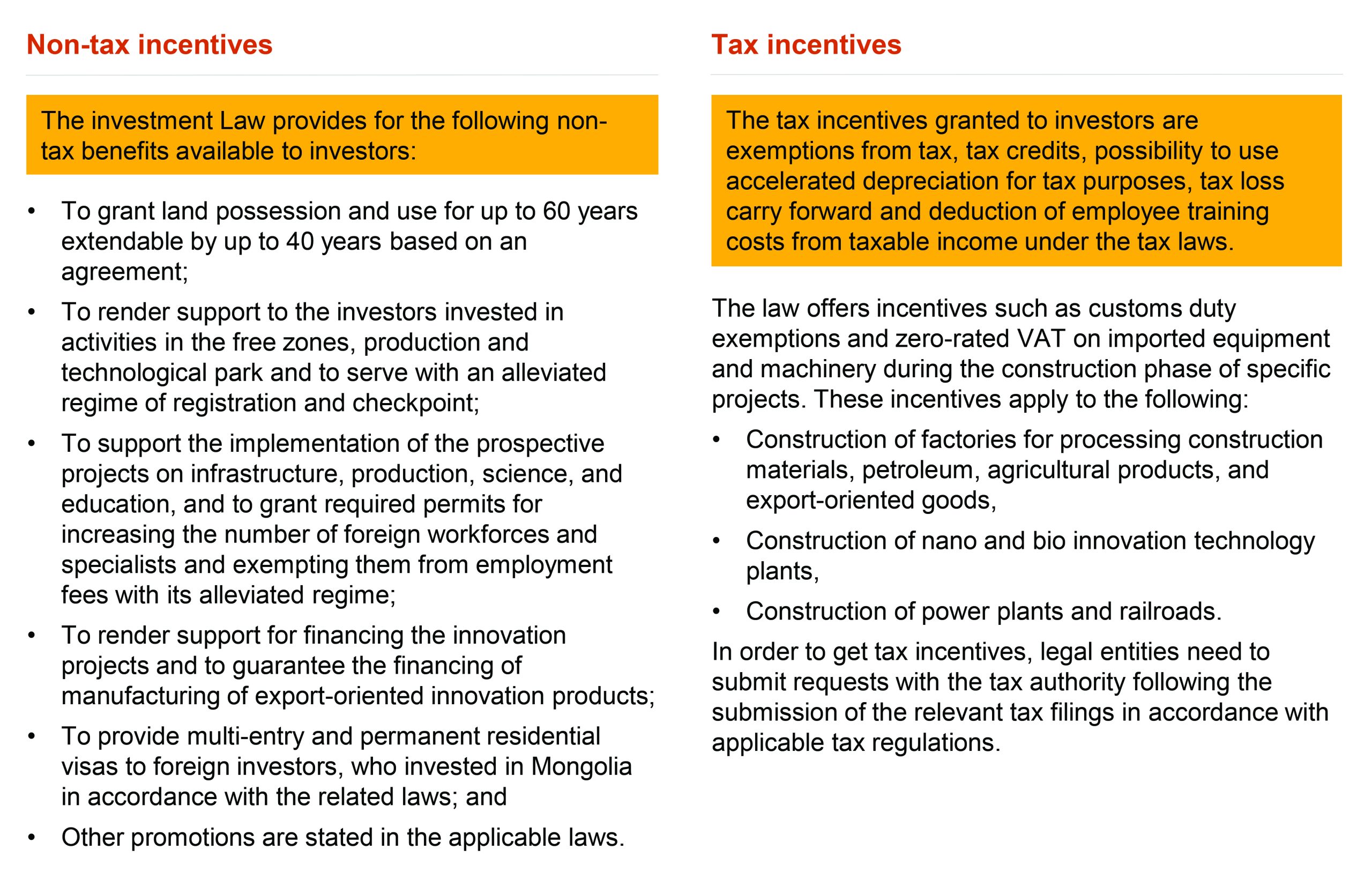

Tax stabilization certificate

Tax stabilization certificate